workers comp taxes for employers

The short answer to this question is no taxes are not normally taken out of workers compensation payments. We want to be your workers compensation agency.

5 Requirements For Workers Compensation Eligibility

According to the federal tax code detailed by the IRS incidental insurance.

. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. In Texas coverage is voluntary for most employers. Start your workmans compensation insurance quote online or give us a call today at 888-611-7467.

Generally workers compensation benefits are not considered income and therefore are not subject to taxes. Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses. If you have any questions regarding the employees work requirements please contact employees manager at telephone.

The fee for covered employees working on the last day of the quarter is 200. These are tax exempt benefits with only rare exceptions. Under most normal circumstances workers compensation payments are tax-free income for disabled individuals who are unable to work on a temporary or permanent basis.

Under workers compensation law an injury or illness is covered without regard to fault if it was sustained in the course and scope of employment ie while furthering or carrying on the employers business. No you do not receive a 1099 for workers compensation. This includes injuries sustained during work-related travel.

Workers compensation is essentially an insurance policy that employers in Tennessee and most of the country have to purchase by law. The employer must obtain a workers compensation insurance policy. Take caution not to directly supervise 1099 workers as that could qualify them as an employee.

If youve received workers comp over the previous tax year you might be wondering whether youll owe taxes on them. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income. However business owners can deduct their workers compensation taxes or payments to cover insurance premiums.

Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute in the nature of a workers compensation act. Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin. The quick answer is that generally workers compensation benefits are not taxable.

Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. Since having workers comp insurance is necessary for running a business business owners are able to deduct the costs of required insurance payments from their taxes. Questions pertaining to Internal Revenue Service workers compensation issues may be directed to our Workers Compensation Center located in Richmond Virginia at 1-800-234-8323.

Workers compensation laws vary by state but all except for Texas require employers with over a certain number of employees to have this insurance. Payment is due by the last day of the month following the end of the quarter. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

What Exactly Is Workers Comp. The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. Business owners are able to deduct the costs of required insurance payments from their tax liability if they are necessary for their business operations.

Well review your current workforce and recommend best options for coverage. Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness. Read on for the answer.

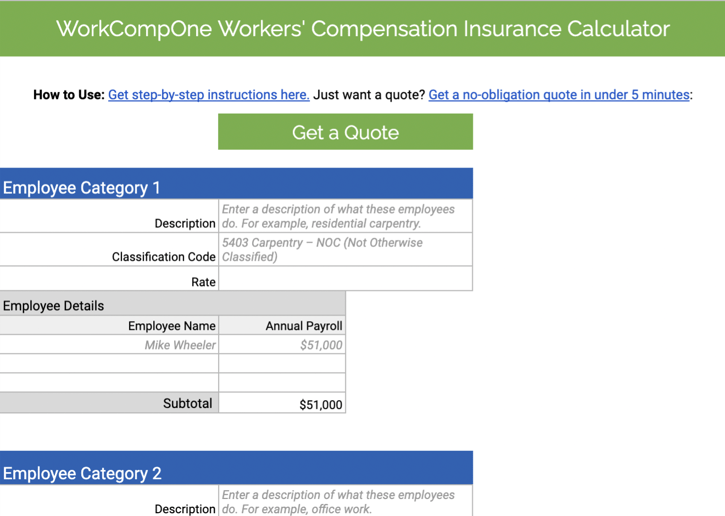

If an injured worker is receiving other types of disability. Now you may want to know. Each employers premium is based on rates for different job categories that are multiplied by.

Matt also was honored on the Best Lawyers a list for Workers Compensation Law Claimants by Best. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Injuries are not covered if they were the result of the employees.

Select Popular Legal Forms Packages of Any Category. All Major Categories Covered. While workers compensation.

Workers compensation benefits do have to be reported on a 1040 but are subtracted from an injured workers total income. About the Author. In this case because the SSDI payment was reduced by 1000 1000 of the employees workers compensation would become taxable.

If an employer sends you a 1099 for workers compensation payments they made a. Yes workers comp is taxable. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Any workers comp payments and benefits that employers pay to their workers is a deductible business expense. The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word. Because they are now above the 80 threshold SSDI would reduce the benefit payment by 1000 to 1200 per month so that total benefits were equal to 80 of 4000 3200.

Recent Internal Revenue Service IRS rules state. Thus while a portion of your workers comp may considered taxable income in practice the taxes paid on workers comp are usually small or non-existent. IRS Publication 525 pg.

He received the Order of Service award from the North Carolina Advocates for Justice in 2017 2018 and 2019. Generally legal settlement awards are taxable and subject to federal taxation. Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards.

Employers with employees are likely required to carry workers compensation insurance to cover injured workers. Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a 1099.

We Get Many Telephone Calls And Emails Asking How To Calculate The Weekly Comp Rate Disabled Employees Want To Know If They Disability Workplace Injury Worker

How To Calculate Workers Compensation Cost Per Employee Hourly Inc

The Workers Compensation Notice Employers Resource

Is Workers Comp Taxable Hourly Inc

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Is My Workers Comp Taxable Ksa Insurance

Workers Compensation Insurance Overview Amtrust Financial

How To Calculate Workers Compensation Cost Per Employee

What Wages Are Subject To Workers Comp Hourly Inc

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Workers Comp Is Never Off The Clock

Is Workers Comp Taxable Workers Comp Taxes

Are Workers Comp Benefits Adequate Legal Talk Network

Infographic How To File For Workers Compensation Infographics Compensation Workers Compensation Insurance Worker

Is Workers Comp Taxable Taxation Portal